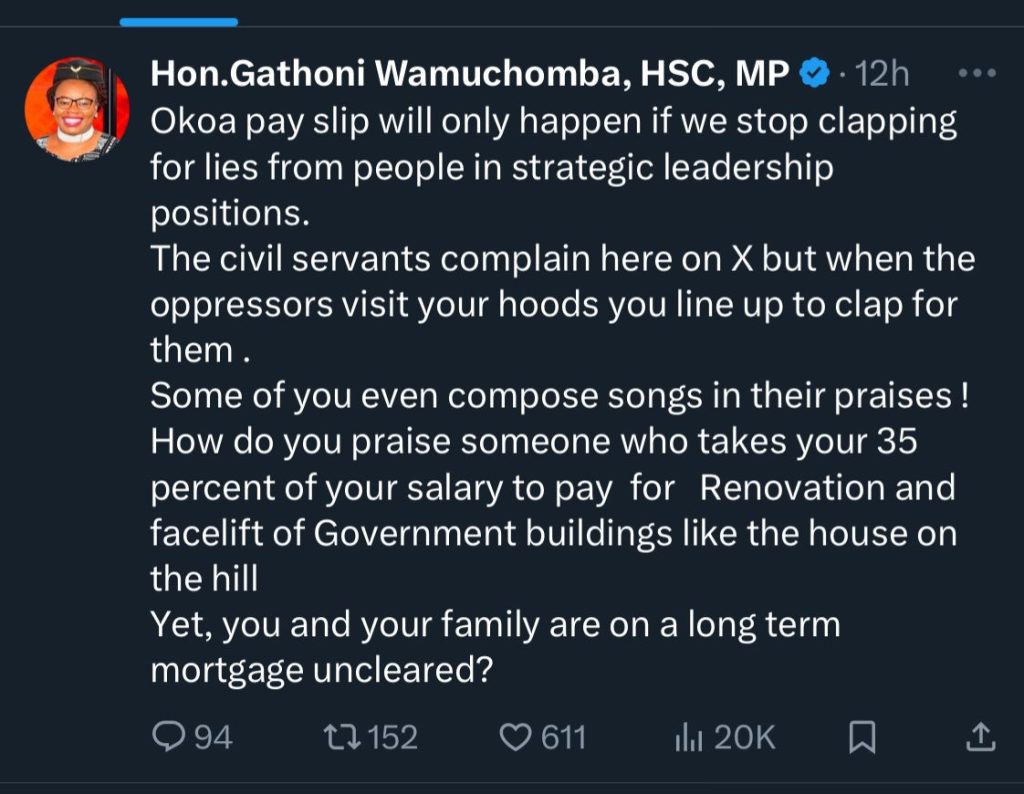

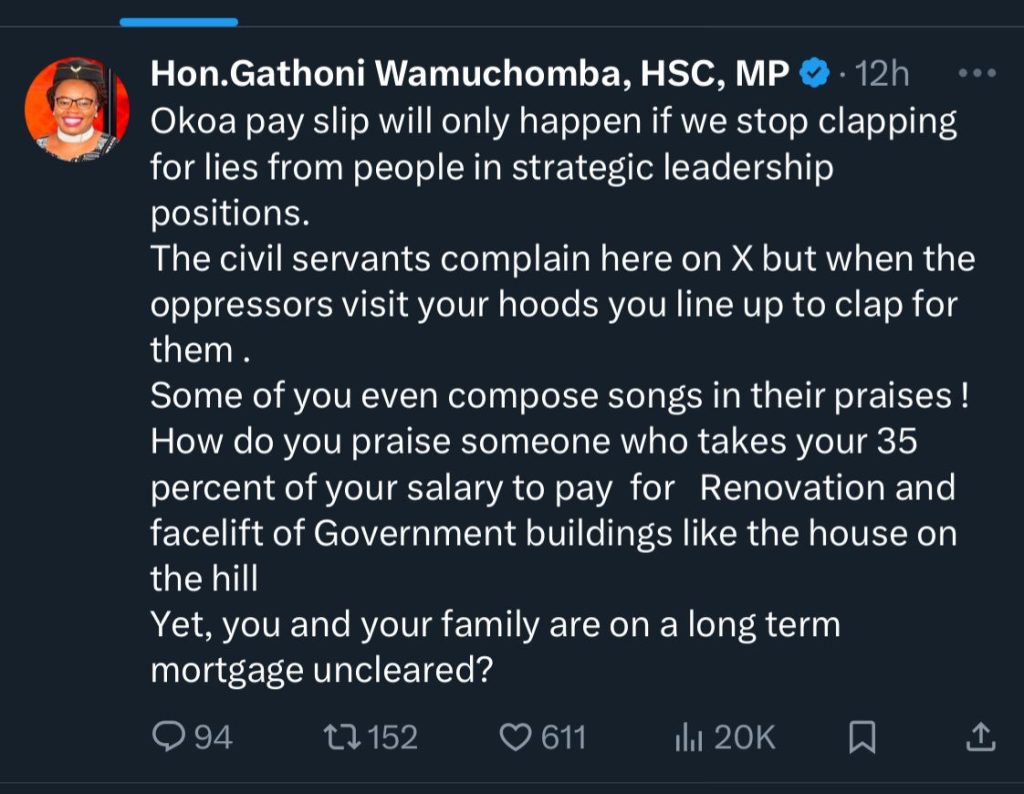

Githunguri MP Gathoni Wamuchomba has criticized Kenyans who continue to praise political leaders who she claims are responsible for the economic hardship.

In a statement shared via her X account on Wednesday, February 6, 2025, Wamuchomba condemned the hypocrisy of citizens who publicly complain about their plight but still offer praise to those in power when they visit their communities.

“Okoa pay slip will only happen if we stop clapping for lies from people in strategic leadership positions. The civil servants complain here on X, but when the oppressors visit your hoods, you line up to clap for them. Some of you even compose songs in their praises!” Wamuchomba stated.

Wamuchomba’s remarks focused on the ongoing struggle of civil servants who are burdened by high taxes and a lack of adequate compensation.

She emphasized that while these workers are being taxed 35 per cent of their salaries to fund government projects, such as renovations to high-profile government buildings, many are still unable to pay off long-term mortgages for their own homes.

She questioned how Kenyans could continue to praise leaders who, according to her, are not prioritizing the welfare of ordinary citizens.

“How do you praise someone who takes your 35 per cent of your salary to pay for the Renovation and facelift of Government buildings like the house on the hill? Yet, you and your family are on a long-term mortgage uncleared?” Wamuchomba noted.

Payslip dignity

Former Deputy President Rigathi Gachaugua recently launched the ‘Okoa payslip‘ mission to counter President William Ruto’s new tax policies.

Speaking from his Wamunyoro residence in Nyeri County via a TikTok live video on February 1, 2025, Gachagua expressed concern over increased tax deductions, likely linked to the recently implemented Tax Amendment Act and Tax Procedures Act, which took effect on December 27, 2024.

“We want to rescue the payslip because the payslip iliguzwa na iko shida mingi sana. (We want) to restore the dignity of the payslip so that the people can do their things,” Gachagua stated.

Adding;

“For our young people, those who are talented and in the online space, we are going to have a conversation with our young people so that they can tell me what they think we can do and what we can put in place so that their lives may be better.”

Gachagua announced plans to engage with young people working in the digital space to discuss the effects of these new taxes.

“They can earn money, they can be able to communicate, they can be able to be heard, their talents can be acknowledged and everybody can know who has the power to do what…that is what I’m planning but most important is to engage with the young people,” Gachagua added.

A key change under the new laws is the doubling of National Social Security Fund (NSSF) contributions for workers earning above Ksh36,000, rising from Ksh2,160 to Ksh4,320.

This third phase of the NSSF Act of 2013 takes effect this month. Both employees and employers are now required to contribute 6% of the employee’s salary to the NSSF.

The digital sector will also be impacted, with the digital service tax being replaced by the significant economic presence tax, which has increased from 1.5% to 3% of turnover. Additionally, a new 5% withholding tax on digital platforms is expected to reduce earnings for content creators and other digital entrepreneurs.