Starting February 2025, consumers in Kenya are likely to experience higher sugar prices due to the implementation of a new tax on both domestic and imported sugar.

Starting February 2025, consumers in Kenya are likely to experience higher sugar prices due to the implementation of a new tax on both domestic and imported sugar.

Agriculture Cabinet Secretary Aden Duale has officially gazetted the Sugar Development Levy Order, 2025, imposing a 4% levy on sugar.

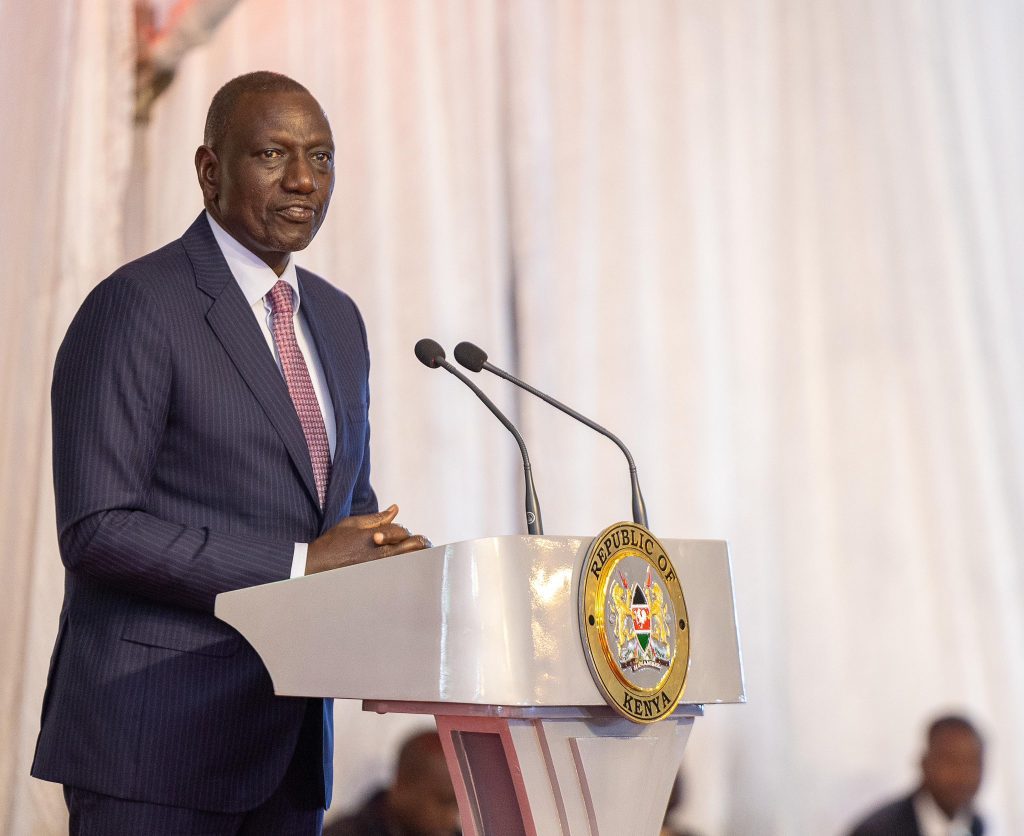

This move follows the enactment of the Sugar Act of 2024, signed into law by President William Ruto in November last year to revitalize Kenya’s struggling sugar industry. The levy is expected to raise sugar prices, with the cost increase likely being passed on to consumers.

Duale explained that the levy, in accordance with Section 40 (1) of the Sugar Act, 2024, applies a 4% rate on the value of domestic sugar and the CIF (Cost of Insurance and Freight) value on imported sugar.

Local sugar millers are required to remit the levy to the Kenya Sugar Board (KSB), which has been re-established as an independent parastatal. The KSB will also collect the levy directly from sugar importers or their appointed agents.

The Agriculture Cabinet Secretary further clarified that the levy must be remitted to the board no later than the 10th day of the month following the month it becomes due.

The allocation of the funds collected from the levy will be as follows: 15% will be used for factory development and rehabilitation, another 15% will be allocated to infrastructure development in sugar-producing regions based on production capacity, and 10% will be directed toward the administration of the KSB.

Furthermore, 5% will benefit sugarcane farmers’ organizations, 15% will go to the Kenya Sugar Research and Training Institute, and 40% will be allocated to directly support farmers.

The Kenya Sugar Board has invited public comments on the proposed Sugar Development Levy Order, 2025, with the deadline set for Tuesday, January 21st. The new levy is set to take effect on February 1st.