Kenya’s import cover has surged to 5.1 months, marking its highest level in nearly six years after a significant rise in foreign exchange reserves, now exceeding Ksh1.57 trillion.

Kenya’s import cover has surged to 5.1 months, marking its highest level in nearly six years after a significant rise in foreign exchange reserves, now exceeding Ksh1.57 trillion.

This milestone, last achieved in June 2019, enhances the country’s buffer against external economic shocks and alleviates concerns about its ability to fund critical imports.

According to the latest Central Bank of Kenya (CBK) data, this marks a sharp turnaround from previous years when the import cover barely stayed above the statutory four-month minimum.

The increase in forex reserves comes at a time when Kenya’s currency and trade balance remain under pressure. In early 2023, the import cover had dropped to just over three months, raising fears about the country’s ability to secure essential goods like fuel.

A combination of higher foreign remittances, improved export performance, and a strategic restructuring of oil import financing arrangements has played a crucial role in reversing this trend.

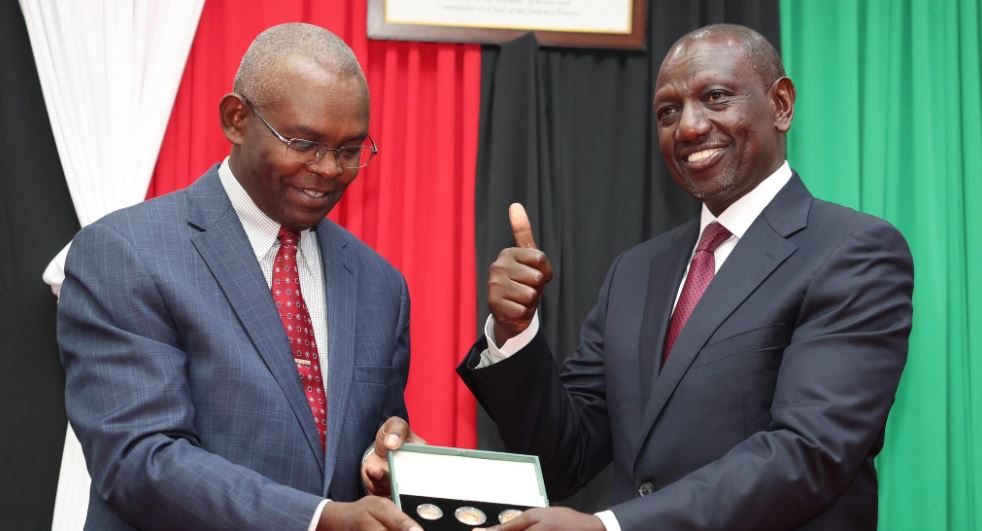

“Maintaining an import cover above five months is a crucial step in strengthening our external position and ensuring stability in trade and financial markets,” said CBK Governor Kamau Thugge.

The governor further highlighted that the increase in forex reserves enhances Kenya’s resilience against global commodity price fluctuations and external debt obligations.

Tourism, Oil Deals Boost Kenya’s Forex Reserves

A key driver of this improvement has been the extended oil import credit deal with Gulf suppliers, which has helped ease forex outflows by allowing Kenya to spread petroleum import payments over an extended period. To meet its agreed fuel volumes, Kenya renewed the deal with three Gulf oil majors following Uganda’s withdrawal from the arrangement.

Surpassing the five-month import cover benchmark marks a significant victory for policymakers and businesses that previously struggled with uncertainty over foreign-sourced goods.

Meanwhile, Kenya’s booming tourism sector has also contributed to stabilizing forex reserves. Tourism earnings are projected to reach Ksh650 billion ($5 billion) in 2025, up from Ksh452 billion in 2024, providing a vital boost to the country’s foreign exchange inflows.

With Kenya’s import cover now exceeding the East African Community (EAC) and International Monetary Fund (IMF) minimum benchmarks, the focus shifts to whether this momentum can be sustained.

However, analysts caution that upcoming external debt repayments and shifting global financial conditions could challenge the stability of Kenya’s forex reserves in the long run.