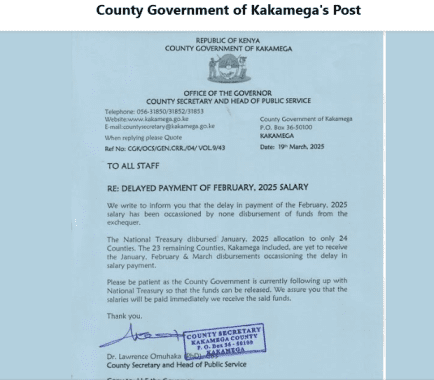

Kakamega county government employees are facing delays in receiving their February salaries due to a lack of disbursement from the National Treasury.

In a statement issued on Wednesday, March 19, 2025, the county’s Head of Public Service explained that the delay is a result of the National Treasury failing to release funds to all counties.

The statement clarified that while 24 counties have received their January allocations, Kakamega and 22 other counties have yet to receive funds for January, February, and March.

“We write to inform you that the delay in payment of the February 2025 salary has been occasioned by no disbursement of funds from the exchequer.

The National Treasury disbursed the January 2025 allocation to only 24 Counties. The 23 remaining Counties. Kakamega included, are yet to receive the January, February & March disbursements occasioning the delay in salary payment,” part of the statement read.

The county government assured employees that it is actively engaging with the National Treasury to expedite the release of the necessary funds. Officials emphasized that once the funds are received, salaries will be paid immediately.

The employees have been urged to remain patient as efforts continue to resolve the matter. The delay has raised concerns among workers who rely on timely salary payments to meet their financial obligations.

“Please be patient as the County Government is currently following up with the National Treasury so that the funds can be released. We assure you that the salaries will be paid immediately we receive the said funds,” the statement read further.

Economic constraints

This comes a month after the National Treasury proposed allocating Ksh2.4 trillion to the National Government and Ksh405.1 billion to counties.

In addition to the Ksh405.1 billion equitable share for counties, Treasury CS John Mbadi had proposed ksh10.6 billion for the Equalisation Fund, which includes Ksh7.9 billion, representing 0.5% of the last audited revenue. The fund is intended to address regional disparities through development projects.

Mbadi also recommended an additional ksh12.8 billion in unconditional and conditional allocations, including court fines (Ksh11.5 million), doctors’ salary arrears (Ks1.7 billion), and a 20% share of mineral royalties. Other allocations include ksh3.2 billion for Community Health Promoters, Ks454 million for county headquarters, and ksh4.5 billion for County Integrated Agro-Industrial Parks.

The Treasury’s proposal fell short of the Commission on Revenue Allocation’s (CRA) recommendation of Ksh417 billion, creating a ksh12.4 billion gap. While the Treasury proposed a ksh17.6 billion increase from last year’s ksh387.4 billion, CRA suggests a ksh30 billion increment for the 2025/26 financial year.

Mbadi justified the figures by citing economic constraints, including low revenue collection due to geopolitical shocks and the government’s fiscal consolidation plan to reduce the fiscal deficit to 4.3% of GDP in 2025/26.

“The Bill proposes to allocate county governments ksh405.1 billion for the financial year 2025/2026 as an equitable share of revenue raised nationally, translating to an increase of Sh17.6 billion from a base of ksh387.4 billion allocated in the 2024/25 financial year,” the proposed law states.

Counties were initially allocated ksh401.1 billion in the Division of Revenue Bill 2024, but senators pushed for Ksh407 billion. However, after the collapse of the Finance Bill 2024 following Gen Z protests, the equitable share was revised to ksh387.4 billion.

Mbadi argued that while the national government absorbs revenue shortfalls, counties receive their full allocation. The Sh405.1 billion proposed for counties represents 25.8% of the last audited national revenue of Ksh1.57 trillion for 2020/21, as per Article 201(3) of the Constitution.