Private universities have submitted a proposal to overhaul the new funding model which if adopted aims to ease financial pressure on the government.

The proposal recommends that the government continue providing loans and scholarships, a replica of the new funding model adopted in 2023 but with a key adjustment of prioritising courses deemed to be of national importance.

In a detailed submission to Education Cabinet Secretary Julius Ogamba, National Association of Private Universities in Kenya (NAPUK) suggests expanding university funding sources beyond government allocations.

Proposed alternatives include partnerships with local and international entities, education bonds, and tapping into unclaimed financial assets.

The association also advocates for the creation of the National Students Financial Aid Corporation (NSFAC) to oversee student loans and grants.

The proposed agency would have a threefold mandate: sourcing funds and administering loans and scholarships, assessing students’ financial needs, and forecasting funding requirements.

“The triple advantage of such a system is that it helps in projecting financial requirements (thus supporting budgeting), determining an individual’s level of need as accurately as possible, and tracking beneficiaries for loan recovery,” the proposal reads.

Additionally, the private universities propose levies on profits and individuals who have benefited from specific training programmes.

The universities also recommend establishing an endowment fund to create a sustainable pool for future funding.

“The body should have the capacity to source funds beyond the Exchequer. It should raise funding from both local and international partners and explore revenue-raising measures such as education bonds, unclaimed financial assets, and training levies from employers,” states the proposal.

A key aspect of the proposal is refining how a student’s financial need is assessed.

Currently, the government uses eight parameters—household income, geographical location, poverty probability index, special circumstances (such as orphanhood or disability), number of dependents, program costs, educational expenditure, and gender.

However, these Multi-Tiered Indicators (MTIs) have faced criticism for potentially disadvantaging students from low-income families.

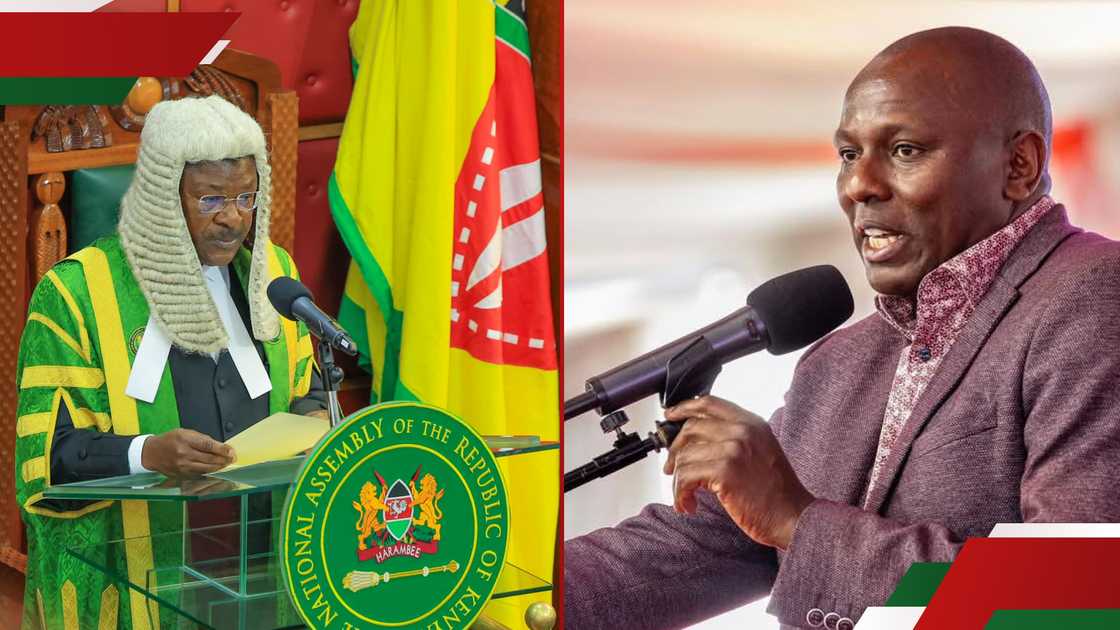

According to the National Assembly’s Education Committee, the current criteria for determining funding eligibility lack validation, raising concerns that deserving students may miss out on financial aid.

Stay informed. Subscribe to our newsletter

In response, the private universities propose an enhanced system that provides a more comprehensive historical financial profile of applicants.

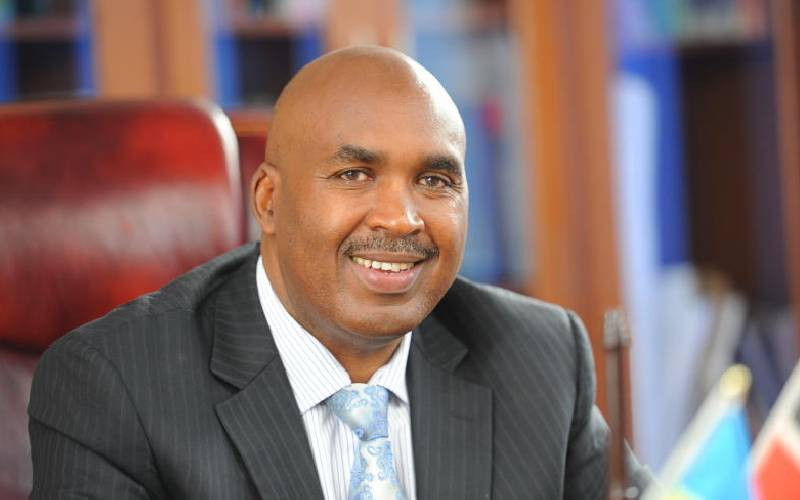

“The current approach, where a student’s level of need is determined upon application, may not be reliable as it fails to provide an accurate historical profile of the applicant. It also hinders future planning, as it is difficult to anticipate financial requirements,” notes the proposal shared by Prof Simon Gicharu, Founder, Mount Kenya University.

To address this, the association proposes developing an information management system to assess a student’s financial background before university enrollment.

They also suggest incorporating input from local administration officers, such as chiefs, for more accurate assessments.

Currently, a student’s financial profile is evaluated only after they have been admitted to an institution.

“The Ministry of Education has a countrywide field network, down to the sub-county level, which could be leveraged to enrich the information system,” adds the proposal.

This proposal follows months of opposition from private universities regarding the new funding model.

In 2023, private university vice-chancellors criticised the model for discriminating against students who enroll in private institutions.

They argued that while students in public universities receive full funding, those in private universities are only eligible for partial financial aid.

Under the new funding model, families that earn less than Sh5,000 will be in band one, and will get 70 percent of scholarship; 25 per cent of their fee will be a loan while the family will cater for 5 per cent.

Band two will receive 60 per cent scholarship, 30 per cent as a loan as the family pays 10 per cent of the fee, while band 3 will receive 50 per cent scholarship, 30 per cent loan and the family pays 20 per cent of the fee.

Students in band 4 will pay 40 per cent of the fee, get 40 per cent scholarship and 30 per cent loan, while students in band 5 are expected to pay 40 per cent of the fee, get 30 per cent scholarship and 30 per cent as a loan.