Treasury Cabinet Secretary John Mbadi has admitted that Kenyans have yet to fully benefit from the economic reforms introduced by President William Ruto’s administration.

Treasury Cabinet Secretary John Mbadi has admitted that Kenyans have yet to fully benefit from the economic reforms introduced by President William Ruto’s administration.

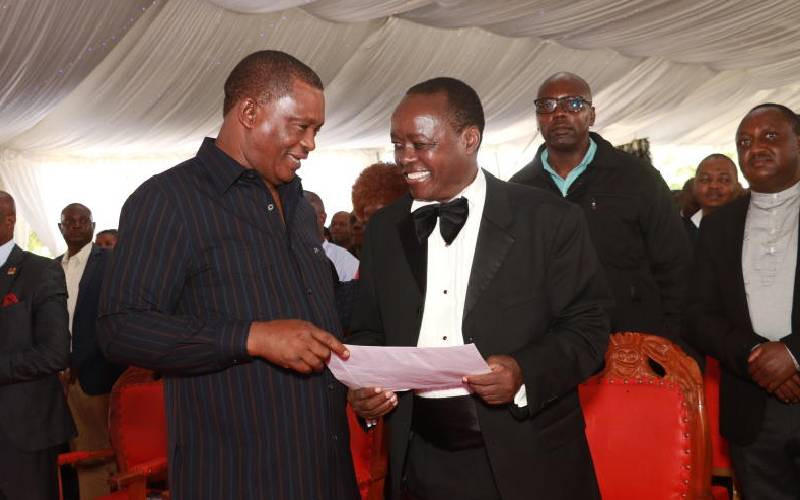

During a Bunge la Wananchi engagement on Monday, February 3, Mbadi addressed concerns raised by citizens about their financial struggles, attributing the situation to three primary factors.

The first factor highlighted by Mbadi is domestic government borrowing. He explained that the government’s reliance on local banks for loans had effectively shut out the private sector from accessing credit. This exclusion prevented businesses and private companies from expanding operations and creating job opportunities for the youth.

“Banks have not been able to give money to the private sector,” Mbadi stated. “They have not been borrowing money to expand their businesses and create job opportunities for the youth.”

The CS noted that efforts are underway to address this issue, with banks now lowering interest rates due to reduced government borrowing.

“That is why we have 4 million Kenyans who are supposed to be working and are not working. You have now seen the banks lowering the interest rates because of the deliberate efforts to reduce government borrowing and interest rates.”

Pending Bills and Tax Deductions

Another significant challenge discussed by Mbadi is the burden of pending bills owed to businesses. He revealed that the government owes approximately Ksh600 billion to various enterprises, particularly small and medium-sized businesses (SMEs).

To tackle this problem, a committee has been established to evaluate these outstanding debts. So far, the committee has verified Ksh200 billion, which will be paid to affected businesses through a supplementary budget. This initiative aims to ease the financial strain on struggling enterprises and support their continued operations.

The third factor contributing to Kenyans’ financial challenges is increased taxation resulting from programs like the Affordable Housing Programme and the Social Health Insurance Fund (SHIF). These initiatives led to higher tax deductions for employed citizens, reducing their take-home pay.

‘We’ve improved people’s payslips’

However, Mbadi emphasized that the government has implemented reforms to mitigate this impact. For instance, SHIF and the Housing Levy are now tax-deductible, ensuring that Kenyans retain more of their income.

Mbadi emphasized that these tax reliefs have positively impacted people’s payslips.

“We have improved people’s payslips; it is only that sometimes we overplay this discussion around payslips getting thinner,” Mbadi said.

He provided a breakdown using the example of a middle-class earner, defined as someone earning between Ksh60,000 and Ksh150,000.

“Let me illustrate with the payslip of someone earning Ksh100,000. Previously, the Social Health Insurance Fund (SHIF) deducted 2.75 percent, which amounted to Ksh2,750 from their salary,” Mbadi explained.

“With the new tax laws introduced in December, the deduction is no longer Ksh2,750 but approximately Ksh1,925. Previously, you also contributed Ksh1,700 to NHIF. If you subtract that amount, you’ll notice the additional amount the government now takes for SHIF is only Ksh225,” he added.

The CS insisted that the government’s tax policies are not as burdensome as critics claim. “Those who are hurt by the taxes are those that Kenyans may call earn super-salaries, but when you start adding it up, you don’t see it as super,” he remarked.

He added that the middle class has experienced less strain under the new tax framework.

Mbadi assured Kenyans that the government remains committed to addressing economic challenges through targeted reforms. By reducing domestic borrowing, clearing pending bills, and adjusting tax policies, the administration aims to improve livelihoods and foster sustainable economic growth.