- Treasury Minister John Mbadi has warned that Kenya should not expect economic recovery soon, as the country is facing a massive debt burden

- Mbadi explained that Kenya avoided a small amount in violation of its Eurobond responsibilities in 2024, which caused the shillings to weaken to Ksh 160 in dollars

- Mbadi also mentioned the improvement of credit rates in Kenya recently by Moody's as a good step, as it could help the country borrow at low interest rates

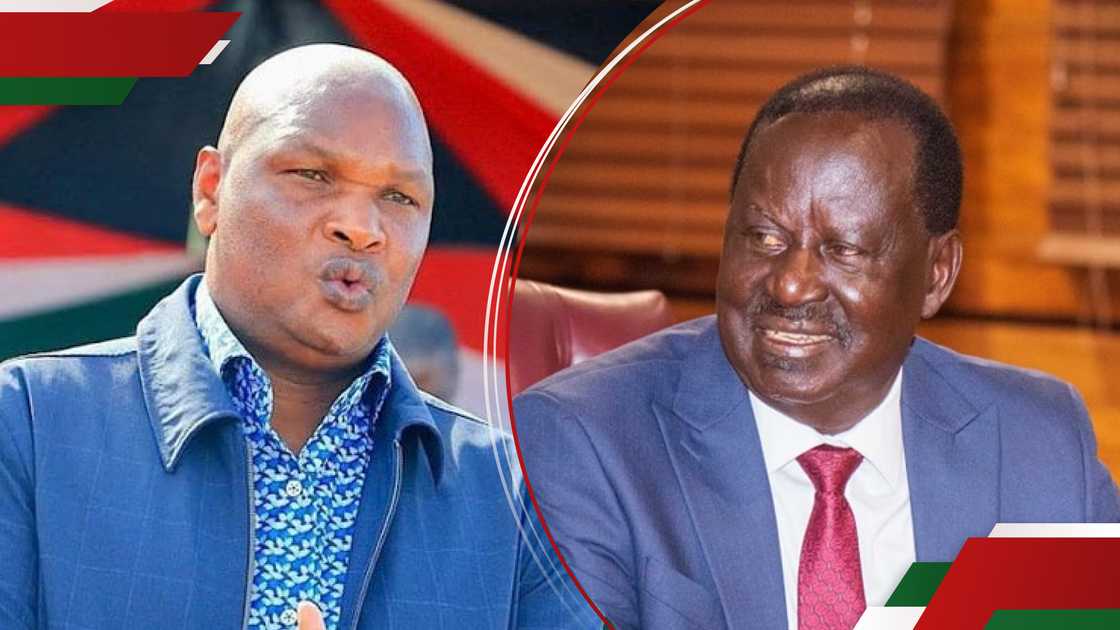

Nairobi – Minister of Treasury John Mbadi He has issued a warning about the effects of Eurobond repayment between 2027 and 2034.

Source: Twitter

Mbadi has warned that the country should not expect any immediate recovery due to the high debt burden in the coming years.

Speaking at a “Citizen Parliament” session held at the Jeevanjee Garden in Nairobi, Mbadi, who was accompanied by the Chairman of the Kenya Tax Authority (KRA), Ndiritu Muriithi, described the impact of public debt and the cost of serving it in the economy Nation.

“When this government came to power in 2022, there were many challenges, and one of which is very sensitive is the public debt and the cost of serving it. /23, it was Ksh 925 billion, which is about one trillion. Mbadi said.

Mbadi added that when the government took office, there were clear signs of failure to repay the Eurobond debt, which almost led to the country's economic crisis.

He noted that as a result of the symptoms, the Kenyan shilling weakened, dropping to KSh 160 in the US dollar due to fear of not being able to repay the debt.

Mbadi said that the government of William Ruto It had a very short time to make the payment and he warned that the country should be prepared to repay its debts on time to avoid economic crisis.

Also read

Justin Muturi Saved Ruto for trying to resolve the crisis in DR Congo while Kenyans are kidnapped

When is Kenya expected to repay Eurobond debt?

In light of the future, the Minister of the National Treasury cited the challenges of national debt payments. He explained that Kenya's financial recovery will not come until 2034.

“Some of you may have heard me say that we will only recover between 2034 and 2048. Why do I say that? , is the deadline.

In 2029 we will pay US $ 1.2 billion (KSh 155.04 billion), in 2031 we owe US $ 1.5 billion (KSh 193.8 billion), and then in 2034 we have to pay US $ 1.2 billion (KSh 155.04 billion). So, the only period in which we will not have any Eurobond to pay is between 2034 and 2048, “ Mbadi explained.

Also read

THIS WEEK THIS WEEK: Buruburu Pasta was arrested for allegedly throwing tomatoes on the ground

https://www.youtube.com/watch?v=OCUCG3Kojqfq

Mbadi emphasized that the National Debt Management Strategy should not wait until 2027 to address these huge debts, warning that long -term waiting will produce a bad signal for the economy and lead to financial and economic crisis, as witnessed in the 2023/24 financial year .

Kenya's debt rating and Moody's

Mbadi also cited the addition of a Kenyan loan mark by Moody's company as a positive sign that would allow the country to borrow through government bonds at low interest due to a decrease in fear of failure to repay debt.

However, the African Peer Review Mechanism (APRM), the African Union (AU), opposed the positive Kenyan debt rating by Moody's.

The APRM claimed that the negative assessment presented previously should not be changed quickly, since Moody's marking in July 2024 was guess of medium term regarding the bill of use.

Read English version

Do you have an exciting information that you would like to publish? Please, contact us via news@tuko.co.ke or WhatsApp: 0732482690.

Source: TUKO.co.ke